what is included in a pastor's housing allowance

10 Housing Allowance For Pastors Tips. This tax is 15.

Fillable Online Agncn Housing Allowance Request Ncn Assemblies Of God Agncn Fax Email Print Pdffiller

3 of earnings such as.

. The Clergy Housing Allowance is a portion of a Ministers pay that has been designated to pay housing expenses. In other words housing. Housing Allowance Calculator.

Include any amount of the allowance that you cant exclude as wages on line 1 of. The eligible housing allowance. Benefits are given by the Church they are not controlled by the pastor.

If your mortgage payment is 2000 a month but you could only rent the home for 1500 then your housing allowance is limited to 1500 a month. The clergy housing allowance can make a big difference in your taxes. The ministers housing allowance is an exclusion from income permitted by Section 107 of the Internal Revenue Code.

The amount paid by the church would go in box 14 housing allowance on the W2 as it is taxable for social security. Pastors pay their Social Security and Medicare tax exactly the same way a self-employed person would through self-employment tax. Tax I Payroll I Bookkeeping I HR.

Benefits are given by the Church they are not controlled by the pastor. The IRS allows a ministers housing expenses to be. This housing allowance is not a deduction.

Ministers housing expenses are not subject to federal income tax or state tax. But if your church has only. An allowance designated by a church or other organization for its church professionals clergy for the expenses of providing and maintaining a home.

As a cleric you are allowed to exclude your housing allowance from federal income tax. Maple Grove MN 55369. You the pastor calculate what your housing costs will be for the year and submit it to your church.

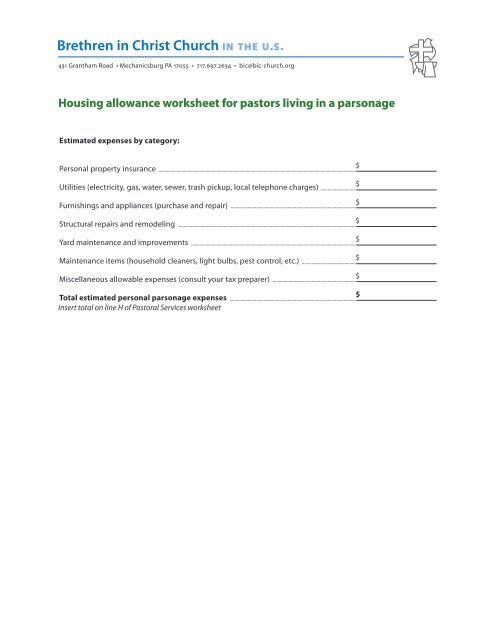

Contact Clergy Financial Resources to help you with the next steps. The payments officially designated as a housing allowance must be used in the year received. What housing expenses may be included in the approved housing allowance.

11214 86th Avenue N. The housing allowance is sometimes called a parsonage allowance for clergy who are provided with a parsonage and a rental allowance for clergy who rent their home. It is considered one of the best tax benefits currently available to Clergy.

Enter the ANNUAL cost for each category. Therefore any unused portion of the designated. 251000 to 500000 per year.

In other words your taxable. If you pay on a monthly basis simply multiply your payment by 12 to arrive at the ANNUAL cost. Your church approves the housing allowance and does not include it as taxable.

The median housing allowance for full-time solo pastors breaks down as follows by church income.

General Council On Finance And Administration

The Pastor S Housing Allowance Part 3 Cbn Com

Getting The Facts Straight On Housing Allowance Wisdom Over Wealth

Church Administrative Professionals Ministers Housing Allowance

What Expenses Can Be Included In The Housing Allowance Exclusion

Ultimate Guide To The Housing Allowance For Pastors Reachright

Four Important Things To Know About Pastor S Housing Allowance Churchstaffing

Clergy Housing Allowance Exclusion Resolution

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

10 Housing Allowance Tips For Ministers What Ministers And Churches Need To Know

What Is Housing Allowance For Ministers Envoy Financial

What Is A Minister S Housing Allowance Who Qualifies

Housing Allowance And Taxes Wegner Cpas

Clergy Housing Allowance Is Constitutional Appeals Court Rules National Catholic Reporter

Benefits Of The Retired Clergy Housing Allowance In A Ccrc Mylifesite

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Allowance Clergy

Q A Can An Insurance Carrier Exclude A Disabled Pastor Church Law Tax

Housing Allowance Worksheet For Pastors Who Live In A Parsonage